Property environments, regardless of property type or geography are highly nuanced and their timeous opportunities for diversified investment are key to overall stable performance over time. One property type that has the eye of astute investors and is fast becoming a global asset, is student accommodation.

In a December 2022 Research.Com article, Chief Data Scientist, Imed Bouchrika, PhD, says that international capital poured into student property markets worldwide has increased by 40% over the past three years. Even so, it is well known in every market, including South Africa, that the short supply of student housing cannot keep up with its demands.

According to Rupert Finnemore, CEO of EasyProperties there are several important reasons why both property developers and seasoned investors are attracted to student accommodation in South Africa.

According to Rupert Finnemore, CEO of EasyProperties there are several important reasons why both property developers and seasoned investors are attracted to student accommodation in South Africa.

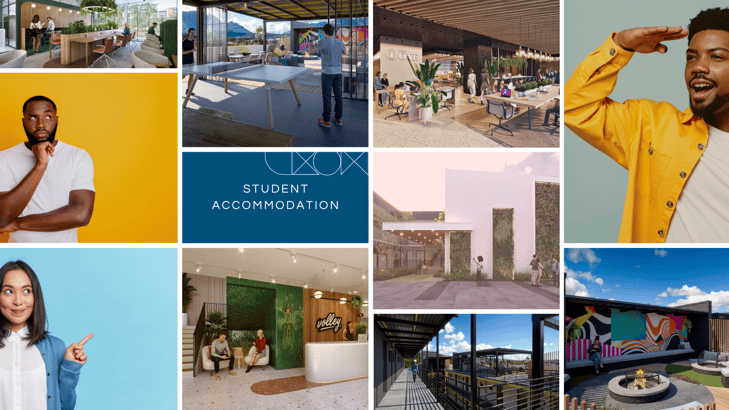

“Much like the growing hybrid lifestyle where work, leisure and community conveniently overlap, there is an increasing preference for students across the globe to seek off-campus accommodation that is specifically geared to meet their needs.”

“There is no doubt that the need for highly secure, WiFi-connected developments that are within walking distance to universities and offer impressive lists of amenities to make the life of the student more convenient than ever before are in demand,” says Finnemore.

From communal study and recreational areas to on-site restaurants, coffee shops, fitness centres laundries and biometric access South African developers are bringing quality products to market.

The Opportunity to De-Risk the Investment

When it comes to student accommodation, the obvious risk of short lease terminations or prolonged vacancies comes to mind. However, in most cases, for the EasyProperties investor, this risk is mitigated by rental guarantees for up to 24 months.

“This is not a small benefit. A rental guarantee de-risks an investment in its entirety from a revenue point of view. Even though there is an overall shortage of student housing, if 200 new units transfer at once, there may be a temporary over-supply in an area. This typically stabilises after a 12-month cycle, but in the meantime, a rental guarantee preserves the investor's return by covering any shortfall, says Finnemore.

Government and Private Sector Buy-In

According to Finnemore, the commitment from both the South African government and business community to address the seriousness regarding the shortage of student accommodation also bodes well for investors.

In the abovementioned Research.Com report, the growing middle class, which is predicted to represent two-thirds of the world’s population by 2030, is cited as one of the greatest demands for student accommodation worldwide. As the middle class is inclined to be heavily invested in education, the assumption is that the demand will continue.

In South Africa, SASAII (South African Student Accommodation Impact Investments) a private investment company that develops and manages affordable, purpose-built student accommodation is a noteworthy example of how private enterprises and the government’s National Student Financial Aid Scheme are leveraging the shortage to do good and stimulate the economy at the same time.

Finnemore cites another local example, DigsConnect, to illustrate the size of the market.

DigsConnect, South Africa’s largest student accommodation marketplace has listed well over one million beds since launching in 2018. Its growth, despite Covid-19 challenges, resulted in its agreement with the world’s largest student accommodation platform, Student.Com propelling them into a further 30 new markets.

“It is unsurprising that capital is pouring into precincts surrounding new student accommodation developments in Stellenbosch like The Edge and The One . In a university town where most of the 30 000 students enrolled originate from outside of Stellenbosch, the potential for rental demand and rental income is predicted to continue unabated,” concludes Finnemore.

The EasyProperties platform, guided by a panel of property experts, offers hand-picked property investment opportunities in the form of fractional ownership shares to investors regardless of net worth or income.

Have you seen the exciting properties currently listed?

To make investing through EasyProperties even more valuable and exciting, we continue to add more excellent properties onto the platform. We are super excited to show you these amazing properties, and we know you will fall in love with them just as much as we do because of the potential income they will provide.

.png)