In the ever-evolving world of property, staying informed about the progress of your investments is crucial. That's why we're delighted to share these updates with you, our valued EasyProperties community.

Property Reports: Your Insightful Guide

Before we dive into the nitty-gritty, a quick reminder: property reports are your golden ticket to track the performance of your investments. Accessible through EasyProperties, these reports give you an in-depth look into each property's journey, keeping you informed and empowered. Investors can easily access these reports by logging into EasyProperties, selecting the desired property, and downloading the report from the Property Documents section under the Description tab.

What's New in Our Portfolio

In FY 2023, we added 94 units to our portfolio, spread across 9 properties with a purchase price worth over R 150 million. This achieved a 100% success rate with our IPO raises, as 9 out of 9 properties reached their target.

Our portfolio currently comprises over 308 units in 34 properties, with a total portfolio value of over R437 million. We are proud to have an incredible community of 100,000+ investors.

We’re not stopping there! There's an upcoming IPO launch scheduled for December 4th 2023 and we currently have The Millennial in Umhlanga on our platform.

Dividends: Sharing Our Success

Our previous quarter saw us deliver R 3.5 million in dividends, having successfully generated profits from 14 property assets. This quarter, we will be distributing another R 2.6 million in dividends, amounting to over R 10 million in dividends distributed this year to over 60,000 investors.

Under Construction: Property Highlights

Now, onto the main event - updates on properties under construction.

Breaking Ground Update: Saxon Square Is Ready to Rise

Saxon Square developers received the green light from the City of Johannesburg Metropolitan Municipality, who dismissed the appeals against the development. This has paved the way for the developers to finalise the administrative procedures required before breaking ground early next year. Saxon Square is projected to achieve an estimated 8.6% net yield upon completion of the development. There is also potential to exceed this projected yield by offering short-term rental stays at the apartments. This development is forecasted to deliver an Internal Rate of Return (IRR) of 10.7% per year for the investment term.

One On Anne: On Track

Snagging has been done in August 2023 and phase 1 of the development is complete. A show unit is up and ready for potential renters to go and view. We are edging closer to doing the transfer of the units and the exciting thing about this development is that the developers will soon be delivering guaranteed rental returns to our investors for 24 months at a 9.5% net yield. This premium Sandringham location offers investors a projected Internal Rate of Return (IRR) of 10.2% per year for the investment term.

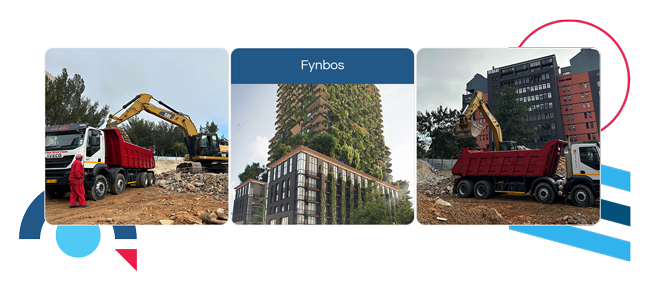

The Fynbos: A Vision Coming to Life

Construction on The Fynbos development is set for completion at the end of next year, with the first apartments ready for occupation in early 2025. The demolition of the existing building at the site has been wrapped up and the excavation and construction of the property has started. Exceptional demand accelerated its IPO, underscoring its appeal to investors seeking future returns. The Fynbos has proven to be very popular with our second Fynbos IPO reaching 100% after just 20 days!

The One: A Student Accommodation Haven

Progress on The One remains on track for completion by November 2024, tapping into the thriving student accommodation market in Stellenbosch with construction having started early this year in May 2023. Stellenbosch has become one of South Africa's top-performing residential investment destinations, thanks to its fast-growing student population. Investors stand to benefit from a 2-year rental guarantee, which will deliver a 6.9% net rental yield. This translates to a projected annual internal rate of return of 9.3% per year for the investment term.

BlackBrick Gardens: A Serene Investment Opportunity

BlackBrick Gardens, the 4th development on EasyProperties from BlackBrick Club, is set to commence construction in February 2024 and complete in the latter parts of the year. This development has attracted 12,500 investors and boasts a 12-month rental guarantee at a net yield of 8.09% once transferred. This property is set to deliver a projected annual internal rate of return of 9.8% per year for the investment term.

Akaru Bryanston: A Tranquil Japanese-Inspired Development

Akaru Bryanston has kicked off the construction process with civils works on site. The serene and tranquil Japanese-inspired development will soon begin its ascent. The more than 15,700 investors can look forward to a projected net yield of 8.66%. This property has an anticipated annual internal rate of return of 9.3% per year for the investment term.

Volley Brooklyn: Student Accommodation Filling Up Fast

Our first student accommodation in Gauteng, Volley Brooklyn in Pretoria, is progressing smoothly, with 95% of the development already fully let for next year. Student occupancy is planned for January 2024, welcoming 91 students. Volley Brooklyn is completely sold out, and the team at Bow & Arc is already working on their second student accommodation named Volley Baileys and has secured another 5 sites for their Volley Student Living Brand. Just a reminder, once the Volley Brooklyn development is finished, investors can expect a guaranteed net yield of 9.36% for 2 years (with a 5% escalation in year 2). This student accommodation in Pretoria is projected to have an internal rate of return of 11.4% per year for the investment term.

Seahorse Knysna: Demolition Scheduled for This Year

Our first property in the Garden Route, Seahorse Knysna, is on track to begin demolition this year, with plans for completion in the latter months of 2024. Over 7,800 investors have the opportunity to enjoy a projected net yield of 8.54% when we operate short-term stays in this jewel of the Garden Route. This property is projected to have an internal rate of return of 8.2% per year for the investment term.

Capital Pearls: A Skyline Marvel in Umhlanga Rocks

Our second property with The Capital Hotels and Apartments group, Capital Pearls, will not be going on auction yet due to an ongoing SARS issue with VAT registration, we are anticipating resolution this year and that the property will transfer in the new year. Investor deposits are sitting in trust and earning interest. This means the property is not yet eligible for auctions and dividends on our platform. Just a reminder, EasyProperties has received a 3 year rental guarantee from The Capital Hotel that guarantees investors a net rental yield starting at 5,9% and escalating at 4% per annum. This development has a projected IRR of 9% per year for the investment term.

Earning While Under Construction

Here's the cherry on top: your money invested in these under-construction properties continues to earn interest. Your investment isn’t sitting idle; it’s busy accruing interest, ensuring your earnings don't stop even during construction phases. One of the benefits of investing in off plan property is that the value could increase between the time you purchase the property and the time the construction on your property is completed.

Dividends & Future Growth

Don't forget our quarterly dividends, distributed as rental income. Whether you cash out or reinvest, it's your key to expanding your investment horizons.

Stay tuned for more updates as our properties continue to grow and flourish. Until next time.

Have you seen the exciting properties currently listed?

To make investing through EasyProperties even more valuable and exciting, we continue to add more excellent properties onto the platform. We are super excited to show you these amazing properties, and we know you will fall in love with them just as much as we do because of the potential income they will provide.

.png)