Where is my property?!

Once an IPO closes on our EasyProperties platform there is a legal process that needs to take place before all the investors – all of us! - formally, become the owners.

The ‘transfer process’ is the legal term that is used to describe this process of changing the legal ownership of a property from the seller to the buyer. It is also known more informally as ‘putting it into the buyers name’. This process can take up to 3 months depending on how busy the relevant government department is at the time and a few other variables – few of which we can control unfortunately.

This process starts once all the suspensive conditions have been fulfilled. Suspensive conditions can be varied but are generally things like, raising the money to pay the deposit by a certain date or getting approval for the bond by a certain date. The deal only goes ahead, once all the suspensive conditions are met. Because EasyProperties has our money upfront, we deliver quickly on our end of the bargain but we still have some delays – like with BlackBrick Cape Town – when developers take a bit longer than planned.

There are a few steps involved in transferring a property once the offer to purchase no longer has any suspensive conditions:

Step 1: The seller appoints a transferring attorney to transfer the property. The transferring attorney asks the buyer to pay the deposit. The deposit is paid into the attorney’s trust account, where it will earn interest, for the buyer – EasyProperty investors - until the property is transferred and the seller is able to be paid for the property.

Step 2: The transferring attorney calls for the title deed (which is a legal document showing ownership of a property) and if there is a bond over the property, cancellation figures are requested from the bank (we don’t have this hold up as our properties to date have all been new properties).

Step 3: The cancellation attorney is asked to cancel the seller’s bond after receiving a guarantee for the amount owing.

Step 4: The transferring attorney receives the title deed and cancellation figures and sends a copy of the deed of transfer and the guarantee requirements to the bond attorney. The transferring attorney requests the buyer and seller sign the transfer documents. The buyer pays the transfer costs.

Step 5: After all the documents have been signed and the costs paid, the transfer, new bond and cancellation bond documents are prepared by the respective attorneys for lodging at the Deeds Office.

Step 6: The Deeds Office takes around two weeks to check the documents, and if they are satisfied with the documents, the transaction is registered.

Step 7: On the day of registration, the seller is paid their proceeds from the sale, the bank is paid any outstanding loan that the seller had. The property is now ‘in the name’ of the buyer and the buyer is legally the new owner. Well done team EasyProperties!

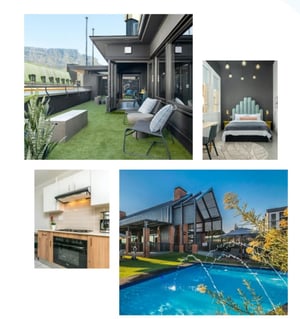

Ready? Check out our the latest EasyProperties IPO by clicking here or below

Click image to view properties

As a reminder, as EasyProperty investors, we hope to earn capital growth when we sell after a few years but also by dividends largely gained from us renting out our properties. However, where transfer hasn’t taken place and we haven’t yet gotten any tenants, we also earn interest on our money – so our investment remains as “safe as houses” as the saying goes.

Learn more property terms here or click below

.png)