By now, you probably know that having some financial investment savvy will pave the road to your future security. You may have even compared all the options and noticed that although all major asset classes have their share of skeletons in the family closet, property is still a safe haven for your income and capital appreciation endeavours over the long term.

But with so many different property types to choose from, which one is right for you? First, that depends on your personal circumstances and stage of life, but if you are a brand new investor here are a few basic terms to help you start your journey.

Residential freehold

If you want to be fully independent of your neighbours and have a bit more authority over your property, then a freehold investment is for you. Even though you will still need municipal approvals for renovations, on the whole, you’ll have more space and more independence than a sectional title investment. Remember though that the size of your property and the associated administration, maintenance and risks are usually proportionate.

Sectional title

A sectional title property comes with several pros and cons. If you are not into major maintenance, and fancy the idea of a lock and go that you could easily rent out for extra income, then a sectional title apartment is for you. You’ll have less privacy and independence than a freehold, but you also benefit from more security. In terms of costs, a sectional title investment can cost less than a freehold home, but remember to budget for building levies on top of your rates. Owning a sectional title property comes with less freedom than a freehold home, but offers the peace of mind in knowing that a body corporate manages the property against strict rules set by the owners.

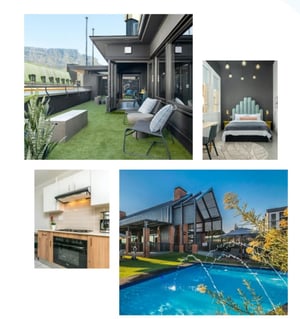

Check out our the latest EasyProperties listing by clicking here or below

Click image to view properties

Commercial

When it comes to investing in commercial property there are income and tax advantages, but in terms of industries and location always make sure that you are receiving the advice of a trusted property expert.

An off-plan development

Buying a property off-plan literally means signing up before one brick is even laid. Investors love off-plan developments for several reasons, but if you are a newbie investor, off-plan is a great way to cut your teeth. Not only are there fewer costs, but there is usually an expert who will take you through a simple step by step process. Off-plan developments are easier to finance because you cross VAT, transfer fees and in some instances, even a deposit off your list of concerns. And if the overall scheme has been financed by one of the bigger banks and you have pre-approval from a bond originator it is even easier.

Best of all – you’ll increase your chances of achieving a healthy rental yield with an off-plan development because tenants love to live in a brand new property where the walls have few stories to tell.

Buying off-plan gives you time to secure a property while you access your finance. Then there’s also the opportunity to choose fittings, fixtures and design styles to give it your personal style too.

In buying off-plan, make sure that you check out the reputation and work of the developer. Also, find out if completion and transfer coincide so that you can avoid occupational rent.

As long as it is done with expert advice to back you up, buying off-plan has more heaps of benefits for the astute investor, especially considering that you have the support of the relatively new Consumer Protection Act behind you too.

Learn more property terms here or click below

Finally, whether you are a brand new or seasoned investor, you could simplify the entire property investment process by benefiting from the long term capital growth and enjoying the rental income while you leave all the admin in the hands of experts who live and breathe property every day. Build a diversified property portfolio within minutes, without any minimums. It’s not too good to be true.

Have you seen the exciting properties currently listed?

Check out the EasyProperties fractional ownership model, which will take care of finance, legalities, tenants, maintenance and insurance for you. Your job, watch your investment grow with the peace of mind that properties have been carefully selected by experts against tried and tested criteria.

.png)